Description

The basic rule: only activities taking place in the fiscal territory, i.e., European waters for charter (rental) or national waters for transport (cruising) are taxable. When the yacht is no longer in the fiscal territory in question, VAT is not applied. Only France and Italy apply this provision.

For a charter departing from France

The activity is measured by the time spent in commercial activity.The VAT payable will be calculated only on the proportion of time spent in EU waters. FLYN-YACHTING will therefore calculate, using AIS points, the time spent in the various national waters (EU / non-EU) and international waters, determine the amount of the VAT base (value of charter less time passed in EU waters over the total period) and therefore the amount of VAT itself. The applicable VAT rate is that of the country of departure for charter services, in this case 20% for France.

Outside the rather exceptional cases of itineraries with the majority of time spent outside of EU waters or a final destination outside of the EU, the resulting VAT rate is not generally much below 20%.

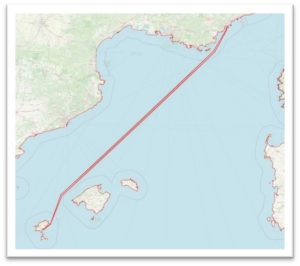

Example: Departure from Côte d’Azur – Ibiza – Côte d’Azur

Charter from 10 to 17 August

Cruising speed 14 knots

Stopover of 3 days and 18 hours in the Spanish waters around Ibiza

Time spent in French waters: 8 hours

Time spent in Spanish waters: 118 hours

Time spent in international waters: 43 hours

Proportion of VAT 20%: (8+118) /(8+118+43)=74.5% i.e., a resulting VAT of 14.9% on this charter agreement TVA résultante de 14.9% sur ce contrat de charter

For a charter departing from Italy

The activity is measured by the time spent in commercial activity.The VAT payable will be calculated only on the proportion of time spent in EU waters. FLYN-YACHTING will therefore calculate, using AIS points, the time spent in the various national waters (EU / non-EU) and international waters, determine the amount of the VAT base (value of the charter less the time spent in EU waters on the total time) and therefore the amount of VAT itself. The applicable rate of VAT is that of the country of departure for charter services, in this case 22% in Italy.

Key: Blue: international waters - Green: EU waters - Red: transition points

Example: departure from Italy (Naples to Sardinia, Southern Corsica, Tuscany and returned to Naples)

Charter from 10 to 15 August

Cruising speed 12 knots

Various stopovers in Italy and in France

Time spent in Italian waters: 81 hours

Time spent in French waters: 17 hours

Time spent in international waters: 32 hours

Pro rata de TVA 22% : (81+17) /(81+17+32)=75,6% soit une TVA résultante de 16,6% sur ce contrat de charter

In the case of a transport agreement departing from France

The activity as measured by the distance covered during the transport service.

VAT is only applied on the activity i.e., the distance covered in the territorial waters of the country of departure. Outside of the territorial waters of this country, VAT does not apply. The applicable rate of VAT is that of the country of departure for transport services (10% for navigation in French continental waters, 0% for international navigation).

The trip is classed as “international”, if:

- the final port of the cruise in question, qualified by disembarkation and/or embarkation of passengers, is in a different country from the country of departure.

- a commercial stopover without disembarkation of passengers, but with purchase of goods and services on board and/or by the passengers has taken place in a country other than the country of departure.

The principle applied is that cruises classed as “international” are totally exempt from transport VAT on departure from all European Union countries.

Reduced transport VAT rates may apply: this is the case for maritime transport in the French territorial waters of Corsica: rate reduced to 2.1% instead of 10%.

There may also be total VAT exemptions for certain types of transport: this is the case for the transport of passengers between mainland France and Corsica under certain conditions.

In the case of a voyage which is not international, the applicable VAT will only apply to the proportion of distances covered in the waters of the country of departure, at the applicable rate. Thus, for example, for a Cannes-Cannes itinerary passing through Bonifacio (without any other stopover in Corsica), the VAT base will be calculated on the basis of the amount of the reduced transport of the distances in non-French waters, and will be distributed, at the rate of 10% (basic transport VAT in France) for the part in continental waters, and at the rate of 2.1% (reduced transport VAT in Corsican waters).

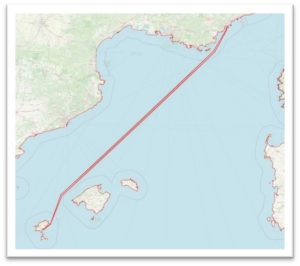

Applying this to the same itinerary as the previous “charter” example:

Example: Departure Côte d’Azur – Ibiza – Côte d’Azur

NB the itinerary could have been further optimised by leaving directly from Cannes to international waters (and vice versa on the return cruise), which would have further reduced the distance in French waters to 24/760 ~3.1% of the cruise, i.e., VAT of …0.3% instead of 1.4%.

Charter from 10 to 17 August

Any cruising speed

Various stopovers in the Spanish waters around Ibiza

Distance covered in French waters: 110.5 NM

Distance covered in Spanish waters: 55.7 NM

Distance covered in international waters: 598.6 NM

The VAT calculation gives, for the same itinerary as in the previous charter example, a rate of VAT of 1.4% instead of 14.9%[1].

[1] Advantage on VAT alone, independently of additional fiscal advantages on the cost of fuel.