Description

For a sale to be tax-free, it is essential that this sale take place outside of the fiscal territory of the EU. Certain countries accept the sale upon a simple exit from territorial waters (France), whilst others (Spain) require passage to a third-party country (typically Tunisia, Algeria, Morocco, Gibraltar, etc.). It is therefore important to provide evidence of the presence of the yacht in international waters, or in the waters of a third-party country, at the time of the sale. In other sale situations, it is preferable to make the sale in an EU territory, so as to maintain the benefit of the VAT paid status.

FLYN-YACHTING will follow the movements of the yacht during the required period to provide the necessary elements of proof.

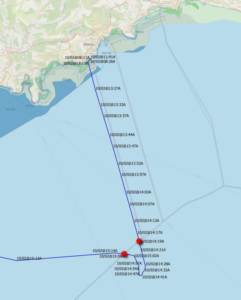

Exemple d’une vente en eaux internationales.

Based on this, FLYN-YACHTING will draft a written certificate which will precisely show the period of time during which the yacht was in international waters, with, where applicable, the provenance from a third-party country. To maintain the benefits of the VAT paid, it is, on the contrary, proof of the presence in the country in question at the time of the sale which will be certified. A detailed map, including the limits of territorial waters, the entry and exit points and the full list of probative points (longitude, latitude, date, and time) is attached to the certificate.

The simple reconciliation between the precise date and time of the certificate of sale and the certificate from FLYN-YACHTING enables the legally valid classification of a sale in international waters or otherwise, for a “VAT paid ” sale of the sale in the territory.