Focus: what are the fiscal rules applicable for charters departing from French Overseas Territories?

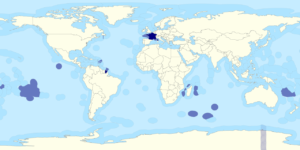

Some French Islands are part of the Union customs territory such as Martinique and Guadeloupe where specific tax exemption regarding charter starting from these destinations are applicable depending on the size, weight, and the itinerary of the yacht. For Saint-Martin and French Guiana no local VAT is applicable.

The other French Overseas Territories are excluded from the EU regulations, there will be no liability incurred by the vessel from cruising and chartering in these areas.

Regarding the 70% rule, the notion of French territorial waters covers also the French waters located overseas. Therefore, a trip made in the FOT waters will not be considered as an international trip.

Click here to read/download the full article: French Overseas Territories regulations.

We hope you’ll enjoy your end-of-winter season there!

For more information, VAT rate and regime applicable do not hesitate to contact FLYN-YACHTING at noemie@flyn-yachting.com